Mortgage calculator with multiple extra payments excel

The rollover payment option or the loan consolidation orption extra payments can be made which decreases the loan balance and reduces the interest paid and shortens the overall term. This is the best option if you are in a rush andor only plan on using the calculator today.

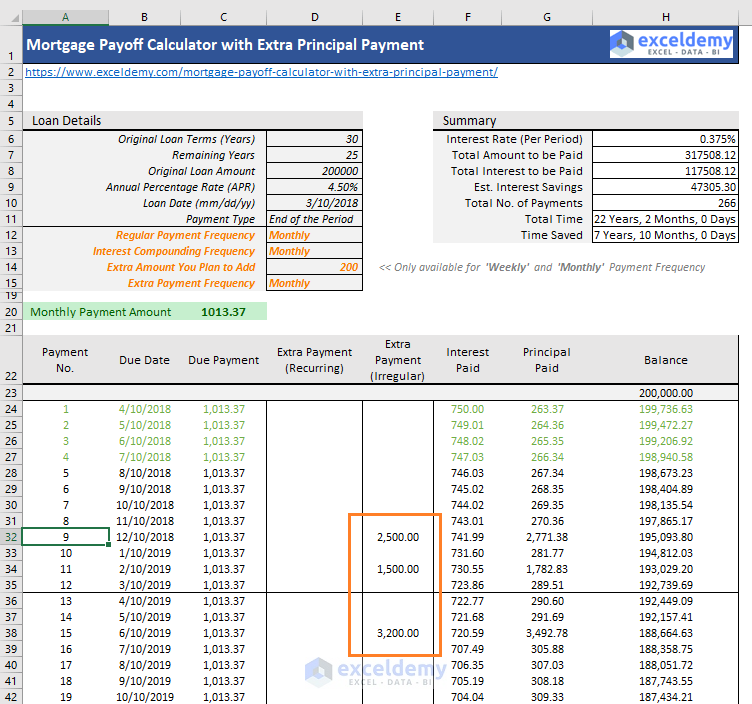

Mortgage Payoff Calculator With Extra Principal Payment Free Template

This is the best option if you plan on using the calculator many times over the.

. ARMs usually come in 31 ARM 51 ARM or 101 ARM. Start by entering your creditors current balance interest rates and monthly payments to see your current total debt average interest rate and. It combines information like your interest rate number of periods and principal to arrive at an amount for.

Make Extra House Payments. This multiple debt payoff calculator tests 5 debt payoff methods to tell you including debt snowball debt avalanche. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan.

These payments in addition to your new mortgage cannot exceed the maximum debt-to-income ratio set by your lender. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. This means higher mortgage payments once interest rates increase.

Mortgage payments can be easily found using your chosen spreadsheet program. Check out the webs best free mortgage calculator to save money on your home loan today. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

Biweekly Mortgage Calculator with Extra Payments. In the 2836 rule this is the 36 part. This function in all major spreadsheet programs Microsoft Excel Google Spreadsheet and Apple Numbers is known as PMT or the payment function.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. Our calculator includes amoritization tables bi-weekly savings. Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more than 65000 in interestcha-ching.

The mortgage calculator spreadsheet has a mortgage amortization schedule that is printable and exportable to excel and pdf. Even if you can add an extra 10 or 20 each month that money helps shorten the amount of time youll have the loan. Mortgage Calculator Excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

For instance if you take a 51 ARM the rate starts off low and you pay the same mortgage payments for the first five years. If you actually want to pay less in interest on a traditional mortgage you need to make extra payments to principal. Understand the function used.

Mortgage calculator with taxes PMI and insurance calculate the impact of taxes PMI and insurance. The second way is to make payments more frequently. Mortgage Calculator solves for.

Squawkfox Debt-Reduction Spreadsheet. Mortgage Calculator zip file - download the zip file extract it and install it on your computer. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or.

Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. Mortgage calculator with extra payments lump-sum or multiple extra payments. If you have an auto loan of 300 a month and receive biweekly checks consider paying 150 with each check.

The author of the spreadsheet and the Squawkfox blog Kerry Taylor paid off 17000 in student loans over six months using this downloadable Debt Reduction Spreadsheet. Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. You enter all your current monthly debt obligations such as car loan payment minimum credit card payments student loan payments etc.

The Ultimate Mortgage Calculator about down payments. Lets say you have a 220000 30-year mortgage with a 4 interest rate. Im using Excel 2010 yes old I know but I doubt if Excel has eliminated the feature.

The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much. So if you pay an additional 100 on top of your monthly mortgage payment your loan balance will be 100 lower for the subsequent month and that means less interest paid over the life of the loan. After the initial teaser period the rate changes annually.

Extra Payment Mortgage Calculator For Excel

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Extra Payment Mortgage Calculator For Excel

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Home Mortgage Calculator For Excel Mortgage Loans Financial Calculators Refinance Mortgage

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Payoff Calculator With Line Of Credit

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com